凍りついていた市場が動き出す?越後湯沢のリゾートマンションに小さな変化が/Is the frozen resort condominium market starting to move? Small changes in the resort condominiums of Echigo-Yuzawa

A negatively rated resort condominium has changed!

About 200 km northwest of Tokyo and approximately 70 minutes by Shinkansen, Echigo-Yuzawa is famous as a hot spring town and is also known as the setting for Yasunari Kawabata’s novel Snow Country. However, it is also a “Ski Ginza,” home to more than a dozen ski resorts, including Iwappara Ski Resort (founded in 1931), Japan’s first commercial ski resort.

During the late 1980s bubble era, the area was even nicknamed “Tokyo-to Yuzawa-mura” (Tokyo’s Yuzawa Village) because so many skiers from Tokyo visited. (At the time, snowboarding was not yet widely recognized in Japan.) On weekends, the roads were packed with skiers traveling to and from the slopes, causing massive traffic jams. There’s even an urban legend that it once took 14 hours to drive from central Tokyo to Naeba Ski Resort!

(English text continues to the latter half of the page)

マイナス評価だったリゾートマンションに変化が!

東京から北西に約200㎞、新幹線で約70分、川端康成の「雪国」の舞台としても知られる越後湯沢は温泉街として有名だけど、日本最初の商業スキー場「岩原(いわっぱら)スキー場(1931年創業)」を始め、町内に2桁の数のスキー場を有する“スキー銀座”でもある。80年代末のバブルの頃には“東京都湯沢村”と呼ばれたように、東京から多くのスキーヤー(当時の日本ではまだスノーボードは認知されていなかった)が訪れ、週末にはスキーの行き帰りの車で大渋滞を引き起こした。東京都内から苗場スキー場まで14時間かかったという都市伝説もあったくらいだ。この時期に雨後の筍のように湯沢町に建設されたのがリゾートマンション、実に湯沢町人口の倍にもあたる15,000戸あまりのリゾートマンションが“建てる端から売れていく”状況でこれまでに高層建築などなかった湯沢町に高層リゾートマンションがニョキニョキと建っていった。まともに考えれば誰がどう考えても供給過剰で、バブルが90年代前半に崩壊するとスキー人口の減少も相まってこうしたリゾートマンションの価格はジェットコースターのように急落していった。自分が所有する30㎡弱の物件は1990年の完成当時は1,400万円、自分が購入した90年代後半では400万円と国産車のセダンよりも安かったが、その価格はやがて大型二輪⇒原動機付自転車⇒ただの自転車といった具合に一方通行の下落相場でその水準を下げていき、2010年以降は売ろうにも売れない、しかもオーナーである限り管理費や税金は永遠に払い続けなければならない状況となり、なんとか死ぬまでに誰かに引き取ってもらいたいという家主が多数生まれた。そうした中で4,5年前には大阪の不動産会社が「あなたの売れない不動産を買い取ります!」というダイレクトメールを湯沢町のリゾートマンションオーナーに送り付けてきた。買取価格は「マイナス百万円」、すなわち百万円(+管理費を1年分程度)を業者側に支払えば物件を引き取ってもらえるというもの。実際に少なくない数のオーナーがこの有料引き取りサービスに乗っかったそうだ。そしてそうした物件がその後どうなったかというと、所有権の移転だけは済ませて後は放ったらかし、税金も管理費も払わず会社にも連絡がつかなくなりいつの間にか会社も廃業、オーナーからせしめた手数料だけ持って逃げた形になり、当該物件は仕方なく多くのマンションの管理組合で競売にかけることに。こんなお粗末な詐欺の舞台になるくらいに湯沢のリゾートマンションは「不動産」ではなく、「負動産」、もしくは「腐動産」の表現そのままの、オーナーにとってのお荷物となっていた。

こうした湯沢町のリゾートマンション市況にこの1年で変化が現れてきたように感じる。苗場近辺のワンルームマンションには依然として値が付きにくいものの(駅から遠く、近くには苗場スキー場以外何もない)、湯沢町内のマンションにはどんなに安いものでも10万円単位で値が付き実際に少なくない数の成約があるようだ。越後湯沢駅から徒歩圏のマンションは100万円単位の価格がついている。こうしたムードの変化は、本当に凍りついたままだった湯沢のリゾートマンション市況の潮目の変化と考えてよいのだろうか。

マンション市況を変えた3つの要因

こうしたリゾートマンション市況の変化について、町内でリゾートマンションの売買仲介を行っている不動産会社の役員と話をする機会に最近恵まれた。最近の市況の変化をもたらした要因は、主に次の3つに分けられそうだ。

1.新たな購買層の出現

バブル前後に湯沢のリゾートマンションを購入した層は現在60~70代、バブル当時は「値上がり益による将来の資産形成」を考えて購入しただろうに、この30数年で人生の半分もの時間をただ下がり続けるだけの市況を見つめてきた世代だ。この世代の購入層は、「湯沢のリゾートマンション」と聞くだけでウンザリする想いに捕らわれるしかないだろう。ところが最近湯沢の不動産会社を訪れる層は、30~40代でゆとりのあるファミリー層が中心のようだ。いわば子供時代に親に連れられてスキーに来た世代だ。親世代と違って彼らにはリゾートマンションを買って値上がり益を得ようという考えなど毛頭ない。ただ自分の小遣い程度でも買えてしまう利便性の高いマンションを手に入れて、ファミリーの生活を豊かにすることが主眼だ。スキー、スノーボードを楽しみ、雪国の生活に興味がある向きには、安過ぎるほどのオファーがふんだんにある湯沢は興味を持って当然の市場だろう。

また地方自治体の移住者への取り組みも重要で、在宅ワークの普及、新潟県へのIターンなどで東京から湯沢町に移住する家族には、湯沢町から一世帯100万円の支援金、さらに18歳未満の子供には50万円/人の子育て加算金が支援されるなど、自治体による手厚い支援も奏功している。

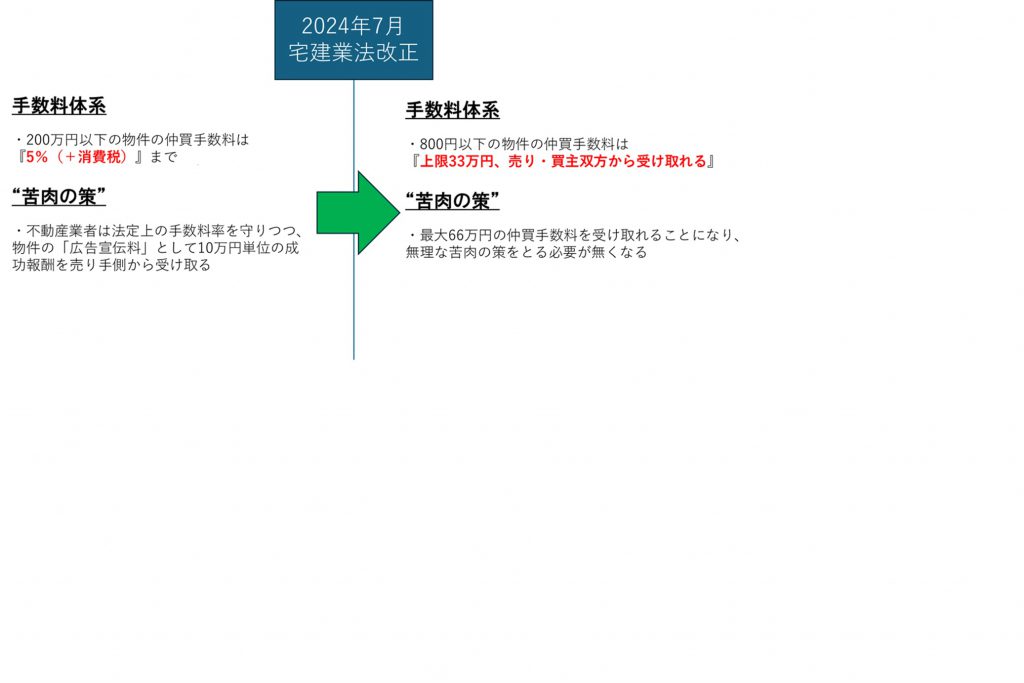

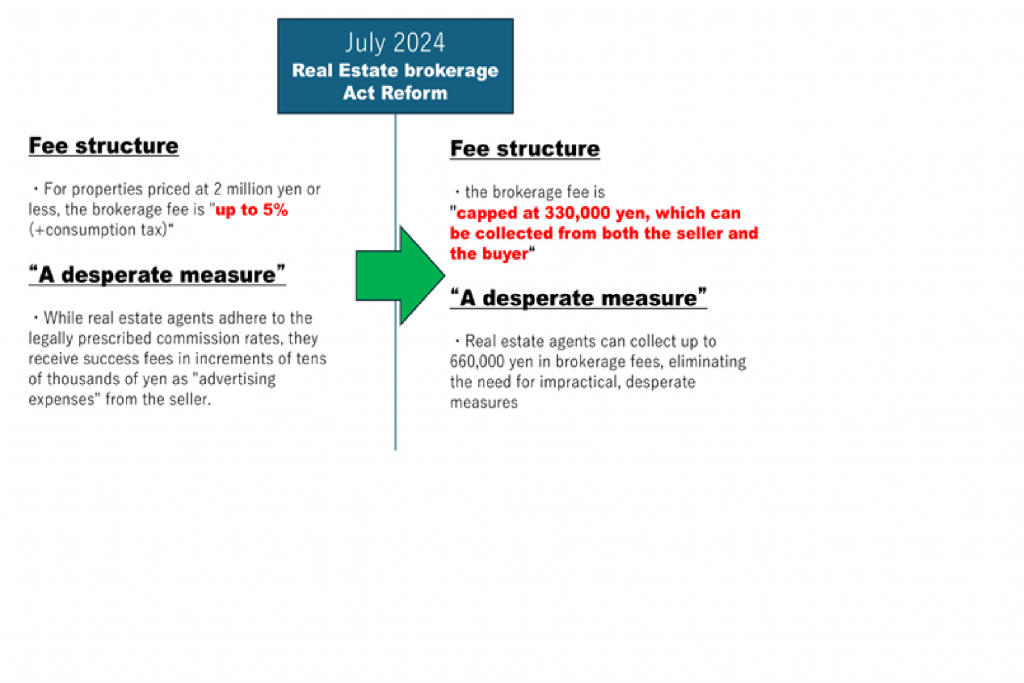

2.政府による法令改正

たとえ極めて低価格でマンションを譲り渡したいオーナーが山ほどいても、それを仲買する不動産会社が動いてくれなければ売買市場は成立しない。これまでの宅建業法では『200万円以下の物件の仲買手数料は5%(+消費税)まで』というのがルールだった。今回お話を聞いたこの役員の方がこれまでに仲買した最低金額の物件は2万円だったそうだ。ここから派生する手数料はわずか千円、とてもじゃないがこんな取引を積極的にやろうとする業者はいないだろう。そのためにこれまでは苦肉の策として、あくまで成功報酬として物件の紹介を「広告宣伝費」として10万円単位でフィーを売り主から請求していたそうだ。

それが2024年7月1日を以て『800万円以下の物件に対して、上限を一律33万円(消費税含む)として売り主、買主、双方から受け取れる』に法令が変わった。これは全国に広がる「空き家問題」に対して政府が見せた取り組みの一つだ。この手数料水準、それも料率ではなく、業者の必要経費を賄える絶対額であれば、これまで“苦肉の策”に不本意なものを感じていた不動産業者も喜んで取引を働きかけることになるだろう。何しろマンションを売りたい人は限りなくいるのだから。

3.インバウンドの出現

円安の追い風もあり、日本全国を訪れる海外からの観光客。その中にも湯沢のリゾートマンションに目をつける向きが出始めた。現在の湯沢は台湾人が大挙して押し寄せるという「台湾バブル」の様相を呈しているが、北海道のニセコや長野の白馬スキー場ほどオーストラリアなどに“占領”されている風には見えない。これは一つにはリゾートマンションから挙がる豊かな税収の恩恵で、湯沢町が本格的な危機をこれまで迎えてこなかったからかもしれない。このため湯沢町で長く観光業などを営む住民はいまだに保守性が強く、外国人の進出を容易に受け入れようとはしない。ただ表面には出てこないものの、中国人の富豪がマンションをまとめて買取り、ビジネスを始めようとしているという噂も聞く。ただこうした動きには各マンションの理事会が不動産業者に圧力をかけ、容易に外国人の大量参入を許そうとはしない。

しかしそれでも時勢には逆らえず、リゾートマンションでも徐々に外国人の姿が見えるようになってきた。直近でのリゾートマンションの成約のうち、10件に1件が外国人だそうだ。おそらく彼らがマンションの中で大きな問題を起こすことなく、住民に受け入れられるようになればその数もこれから大きく増えていくことになるだろう。彼ら外国人が市場に参入してくる意義は大きい。バブル後期に続々と建てられたリゾートマンションの多くは築30年以上、新築が喜ばれる日本人の感覚では魅力に欠ける。しかし外国人、特に欧米系の人間は建物の古さを気にせず、むしろ古いものを尊ぶ風潮がある。健全な市場の条件は、あらゆる嗜好を持った人間が参加すること。外国人が本格的にリゾートマンションに目を向ければ、新たな需要創出が可能になるかもしれない。

実は自分の住むマンションでも今シーズンから新しくオーストラリア人の夫婦が住み始めた。これまでに中国人のオーナーはいたが、オーストラリア人は初めてかもしれない。話を聞いてみると、オーストラリアで会社経営をしていた人物で、50歳でセミリタイアして、(日本の)冬期間は湯沢のマンションでスノーボード、春になるとオーストラリアに帰ってサーフィン三昧という何とも羨ましい境遇のナイスガイ。以前からニセコや白馬を始め、国内のスキー場を廻ってきたが、数年前からは湯沢エリアが気に入り、ここにまず一軒家を買おうとした。実際にいくつかの物件を廻ったが、どこの大家も外国人には売ってくれようとはしなかったと言う。確かにこの地域で一軒家を持てば、冬場は絶えず雪かきの必要があり、素性の知れない外国人に家を売って雪かきせずに放っておかれたら近隣住民にも被害を及ぼす。家族で長くこの地に住んでいる大家であるなら、家を売っても地域コミュニティとの縁が切れるわけではないので、不動産の売買にはかなり慎重になるのは当然だろう。

このような経緯で一軒家を諦めて、ふんだんにオファーのあるリゾートマンションを買おうと決意したという。最初にマンション価格を見たときにその安さに驚愕し、ひょっとしたら不動産業者が豪ドル建ての価格を提示したのかもしれない、とさえ思ったらしい。また売り主のご夫婦は90年11月の完成時から物件を所有するオーナーだったが、「本当にこの価格でよろしかったでしょうか」ときわめて謙虚で、これを見て一切価格交渉することなく購入を決めたそうだ。もちろん外国人がマンションを買うには、月次管理料を引き落とす国内銀行口座や、連絡がとれなくなった時の保証人など多くの障壁がある。こうした障壁へのソリューションを与える「日本トレーディング合同会社(https://nippontradings.com/)」という会社も福岡に現れた。これまでに会った外国人のマンションオーナーはほぼすべてこの会社のサポートを受けているそうだ。

湯沢エリアのリゾートマンションの理事会の多くは、いまだにトラブルを恐れて「変な外国人に物件を仲買するな」と、不動産業者に圧力をかけ続けているらしい。しかしまだ少数の彼ら外国人オーナーが問題を起こすことなく、住民の良き仲間になる事例が増えてくれば、この外国人を敬遠する風潮もかなり変わってくるのではないか。現在のところ、マンションの成約全体の中で外国人の割合は1割程度、しかしこれは将来の大きな可能性を秘めた「1割」であるように感じている。

A Change in the Negatively Rated Resort Condominiums!

Located about 200 km northwest of Tokyo and approximately 70 minutes by Shinkansen, Echigo-Yuzawa is famous as a hot spring town and is also known as the setting for Yasunari Kawabata’s Snow Country. However, it is also a “Ski Ginza,” home to more than a dozen ski resorts, including Iwappara Ski Resort (founded in 1931), Japan’s first commercial ski resort.

During the late 1980s bubble era, the area was even nicknamed Tokyo-to Yuzawa-mura (Tokyo’s Yuzawa Village) because so many skiers from Tokyo visited. (At the time, snowboarding was not yet widely recognized in Japan.) On weekends, the roads were packed with skiers traveling to and from the slopes, causing massive traffic jams. There’s even an urban legend that it once took 14 hours to drive from central Tokyo to Naeba Ski Resort!

During this period, resort condominiums sprang up in Yuzawa like mushrooms after the rain. A staggering 15,000 units—twice the town’s population—were built, selling as fast as they were constructed. High-rise resort condos shot up in Yuzawa, a town that had never seen such tall buildings before.

Looking at it rationally, anyone could see that this was an oversupply. When the bubble burst in the early 1990s, ski tourism also declined, and the prices of these resort condominiums plummeted like a roller coaster. The unit I own, which is just under 30 square meters, was priced at 14 million yen when it was completed in 1990. By the late ’90s, when I bought it, the price had dropped to 4 million yen—cheaper than a mid-sized domestic sedan. But the price continued its one-way downward spiral, dropping from the equivalent of a large motorcycle to a moped, then to an ordinary bicycle.

By 2010, these condos had become practically unsellable. Yet, as long as you remained the owner, you had to keep paying management fees and taxes indefinitely. Many owners were desperate to offload their properties before they died.

Then, about four or five years ago, a real estate company from Osaka sent direct mail to resort condo owners in Yuzawa, offering to buy their unsellable properties! But the catch? The “purchase price” was negative one million yen—in other words, the owner had to pay the company one million yen (plus about a year’s worth of management fees) to have the property taken off their hands. Quite a few desperate owners accepted this “paid disposal” service.

And what happened to those properties afterward? The ownership was transferred, but the company simply abandoned them, failing to pay taxes or management fees. Eventually, they became unreachable, and the company went out of business, vanishing with the fees collected from the former owners. As a result, many condo management associations had no choice but to auction off these abandoned units.

This kind of low-level scam was just one example of how Yuzawa’s resort condominiums had become not real estate (fudōsan 不動産), but rather “negative estate” (fudōsan 負動産) or even “rotten estate” (fudōsan 腐動産)—a massive burden for their owners.

I feel that the market for resort condominiums in Yuzawa has started to show signs of change over the past year. While studio apartments near Naeba still struggle to attract buyers—mainly due to their remote location and the lack of amenities beyond Naeba Ski Resort—condos within Yuzawa Town itself are now selling for at least several hundred thousand yen.

Even the cheapest units are fetching prices in the tens of thousands, and a notable number of transactions have taken place. Condominiums within walking distance of Echigo-Yuzawa Station are now being priced in the millions.

Could this shift in sentiment be seen as a turning point for Yuzawa’s long-frozen resort condo market?

Three Factors That Changed the Condo Market

Recently, I had the opportunity to speak with an executive at a local real estate company in Yuzawa that specializes in resort condo transactions. According to them, the recent changes in the market can be attributed to three main factors.

- The Emergence of a New Buyer Demographic

The generation that purchased Yuzawa’s resort condominiums around the bubble era is now in their 60s and 70s. Back then, they likely bought these properties with hopes of capital appreciation and future asset building. However, for the past 30 years, they have only watched prices continuously decline. Understandably, when they hear the words “Yuzawa resort condo,” it likely evokes nothing but frustration.

In contrast, the people now visiting Yuzawa’s real estate agencies are mostly in their 30s and 40s—financially stable families. This is the generation that, as children, were brought to Yuzawa by their parents for ski trips. Unlike their parents, they have no expectations of price appreciation. Instead, they are focused on acquiring affordable and conveniently located condos to enrich their family life.

For those interested in skiing, snowboarding, or experiencing life in a snowy region, Yuzawa presents an extremely attractive market, filled with offers that are almost too cheap to pass up.

Additionally, local government initiatives to attract new residents have played a crucial role. With the rise of remote work and the I-turn migration trend to Niigata Prefecture, families relocating from Tokyo to Yuzawa can receive a subsidy of 1 million yen per household, along with an additional 500,000 yen per child under 18. These generous municipal incentives have also contributed to the shift in the market.

- Legal Revisions by the Government

Even if there were countless owners willing to transfer their resort condos for extremely low prices, the market wouldn’t function without real estate agencies willing to facilitate transactions.

Previously, Japan’s Real Estate Brokerage Act set the brokerage commission for properties priced at 2 million yen or less at a maximum of 5% (plus consumption tax). The executive I spoke with mentioned that the lowest-priced property they had ever brokered was sold for just 20,000 yen. Under the old regulation, the brokerage fee for such a transaction would have been a mere 1,000 yen—hardly an amount that would incentivize any real estate agency to handle such deals.

As a workaround, agencies had been charging sellers a separate fee in the tens of thousands of yen under the guise of “advertising costs,” structured as a success-based reward.

However, on July 1, 2024, the law was revised. Now, for properties priced at 8 million yen or less, the brokerage commission has been standardized at a maximum of 330,000 yen (including tax), which can be charged to both the buyer and the seller.

This revision is part of the government’s broader effort to address the growing akiyā mondai (vacant housing problem) across Japan. With a commission structure that guarantees a sustainable level of revenue—based on an absolute amount rather than a percentage—real estate agents who previously found these transactions unprofitable are now much more willing to handle them.

After all, the supply of sellers eager to offload their resort condos is virtually limitless.

- The Emergence of Foreign Buyers

With the yen’s depreciation providing a tailwind, Japan has seen an influx of international tourists, and some of them have begun to take an interest in Yuzawa’s resort condominiums.

Currently, Yuzawa is experiencing what could be called a “Taiwan bubble,” with large numbers of Taiwanese visitors. However, unlike Hokkaido’s Niseko or Nagano’s Hakuba, which have been heavily “occupied” by Australians and other foreigners, Yuzawa has remained relatively untouched. This may be because the town has never faced a severe financial crisis, thanks to the substantial tax revenue from resort condos. As a result, long-time residents in the tourism industry tend to be conservative and hesitant to embrace foreign buyers.

That said, there are rumors that wealthy Chinese investors have already begun purchasing multiple condo units with plans to start businesses. However, local condominium management boards have been pressuring real estate agencies to prevent large-scale foreign ownership, making it difficult for outsiders to enter the market.

Despite this resistance, the tide is slowly shifting. Currently, about one in ten recent resort condo transactions involve foreign buyers. If these foreign owners integrate well into the community and avoid causing issues, their presence will likely grow significantly in the future.

Foreign investors play a crucial role in revitalizing the market. Many of Yuzawa’s resort condos, built during the late bubble era, are now over 30 years old—a factor that makes them less attractive to Japanese buyers, who generally prefer new properties. However, Westerners often appreciate older buildings, sometimes valuing their character rather than seeing them as outdated. A healthy real estate market thrives on diverse buyers with different preferences, and if more foreigners start purchasing these condos, it could create new demand and market stability.

A Case Study: An Australian Buyer

A recent example from my own condo building illustrates this trend. This season, an Australian couple moved in, marking the first time an Australian had purchased a unit in the building, although there have been Chinese owners before.

The husband, a former business owner in Australia, semi-retired at 50. He now spends winters snowboarding in Yuzawa and summers surfing back in Australia—a lifestyle many would envy.

He had previously explored Niseko, Hakuba, and other Japanese ski resorts, but in recent years, he became particularly fond of Yuzawa. Initially, he wanted to buy a detached house rather than a condo. However, despite viewing multiple properties, no homeowners were willing to sell to a foreigner.

The reluctance to sell houses to foreigners is understandable in this region. A standalone house requires constant snow removal in winter, and if an absentee foreign owner neglected this responsibility, it could negatively impact the surrounding community. Since local homeowners often have deep ties to the area, they are naturally cautious about selling to buyers who might not maintain the property.

Faced with these challenges, he shifted his focus to the resort condo market, where supply is abundant. He was shocked by the affordability of the units, initially suspecting that the real estate agent had mistakenly quoted prices in Australian dollars.

The sellers, a Japanese couple who had owned the unit since its completion in November 1990, were extremely humble and even asked if he was sure about the price. Their sincerity impressed him, and he decided to buy the condo without any price negotiation.

Of course, foreigners purchasing Japanese real estate face various logistical hurdles, such as:

The need for a Japanese bank account for automatic payments of monthly maintenance fees

The requirement to designate a guarantor in case they become unreachable

To address these issues, a specialized real estate service called Nippon Trading International (https://nippontradings.com/), based in Fukuoka, has emerged. According to the Australian buyer, nearly all foreign condo owners he has met have used this company’s support.

Future Outlook: A Potential Turning Point

Many condominium boards in Yuzawa still pressure real estate agents to avoid dealing with “unfamiliar” foreign buyers, fearing potential trouble.

However, if foreign owners continue to integrate smoothly into the community, attitudes may gradually shift.

Currently, foreigners account for only 10% of recent condo transactions, but this “1 in 10” could be a key indicator of major changes ahead.